The following steps describe how to add and manage tax classes in Magento.

Step (1): Login to your magento admin panel.

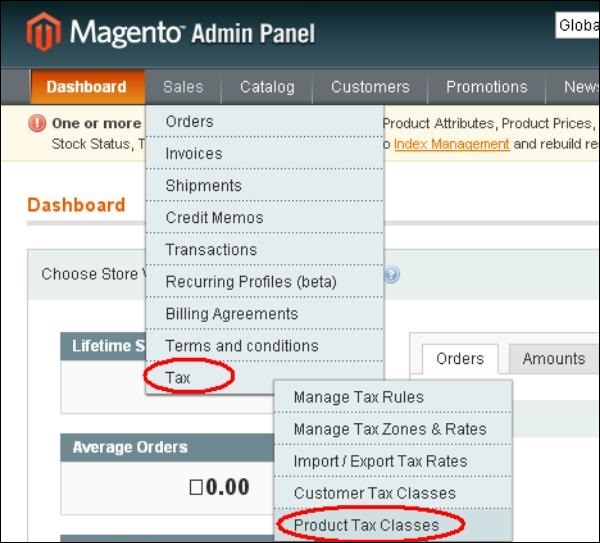

Step (2): Go to Sales menu > Tax and click on the Product Tax Classes option.

Step (3): Product class is a type of product that is being purchased. It includes two product tax classes:Taxable Goods and Shipping. To add new product tax class, click on Add New button as shown in the screen.

Step (3): Product class is a type of product that is being purchased. It includes two product tax classes:Taxable Goods and Shipping. To add new product tax class, click on Add New button as shown in the screen. Step (4): Next enter name for your product tax class in the Class Name box and click on the Save Class button in the upper right corner.

Step (4): Next enter name for your product tax class in the Class Name box and click on the Save Class button in the upper right corner.

Set up Tax Rates

Tax rate is combination of tax zone (such as country, state or zip) and percentage. You can setup tax rates as shown in below steps.Step (1): Login to Magento Admin Panel.

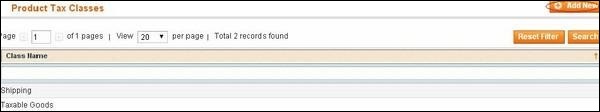

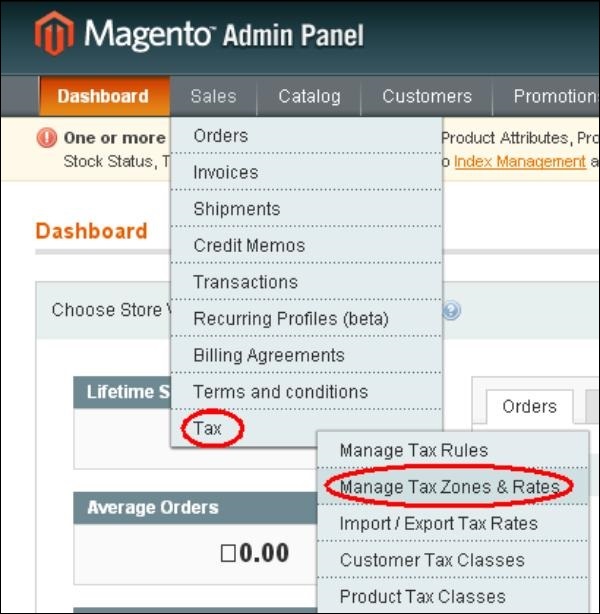

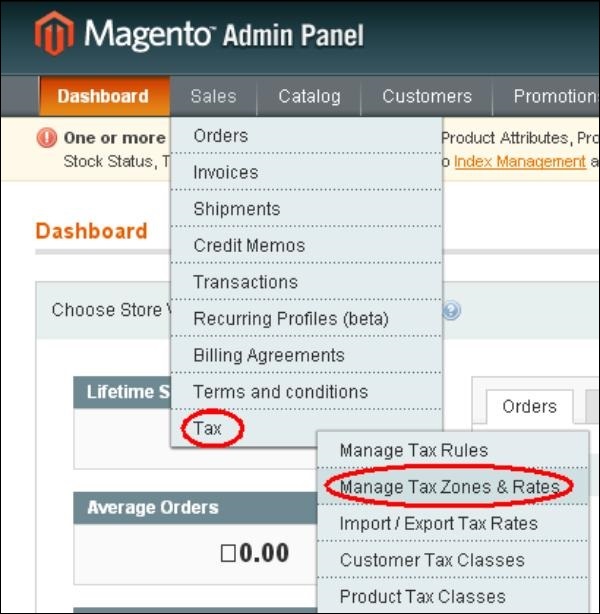

Step (2): Go to Sales menu > Tax and click on the Manage Tax Zones & Rates option.

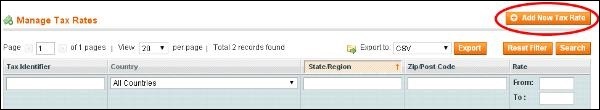

Step (3): Under Manage Tax Rates window, click on the Add New Tax Rate button.

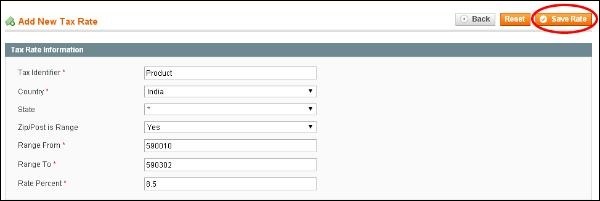

Step (3): Under Manage Tax Rates window, click on the Add New Tax Rate button. Step (4): It provides several options such as:

Step (4): It provides several options such as:- Tax Identifier. This field defines the title of the newly created tax rate.

- Country and State fields describes the country and state to which the specific tax applies. You can select country and state from the dropdown options given to you.

- Zip/Post is range(set to Yes) field provides two fields Range From and Range To. These fields show the starting and ending of ZIP code range.

- Rate Percent specify the percent of the tax rate.

Setup Tax Rules

Tax rules are entities that combine product tax classes, customer tax classes and tax rates. Without setting up tax rules, taxes will not be applied. It determines how tax will be applied on each order that is placed in the store.The following steps describe how to add tax rules for products in Magento:

Step (1): Login to your Magento Admin Panel.

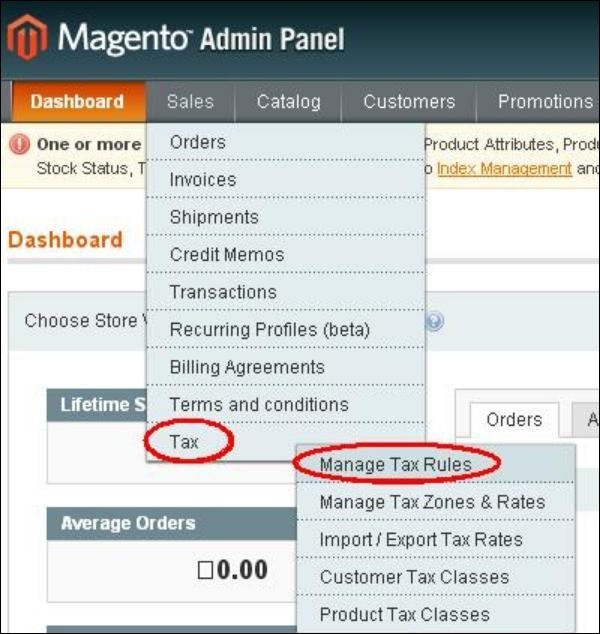

Step (2): Go to Sales menu > Tax and click on the Manage Tax Rules option.

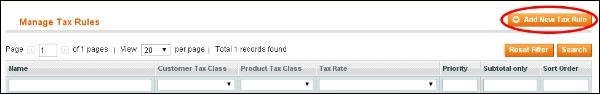

Step (3): To add new tax rule, click on the Add New Tax Rule button in the top right corner.

Step (3): To add new tax rule, click on the Add New Tax Rule button in the top right corner. Step (4): It contains some settings such as:

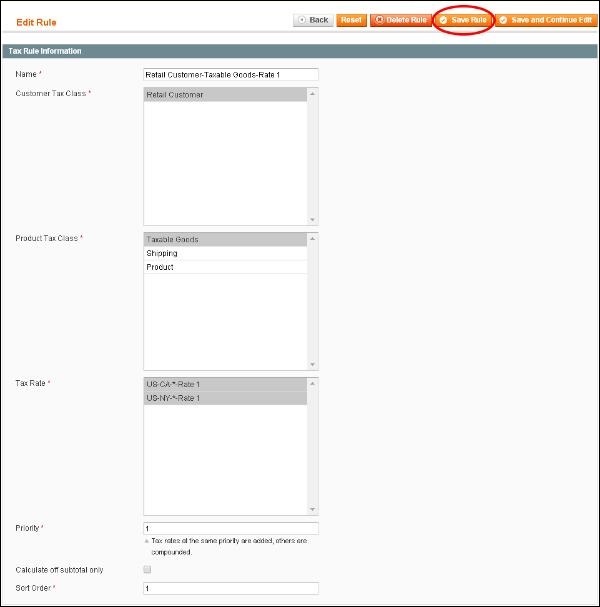

Step (4): It contains some settings such as:- Name field specifies name for tax rule,

- Customer Tax Class field displays the list of customer tax classes that you have created

- Product Tax Class field displays the list of product tax classes that you have created

- Tax Rate field selects the tax rate which you want to apply to this rule

- Priority field specifies when the tax should be applied to other tax rules

- Sort Order field displays the order in which tax rules should be displayed.

Import/Export Tax Rates

Magento provides support for exporting and importing tax rates to the webstore. You can set up different tax percentages settings per different zip code. You can edit the rates in excel and import them back.The following steps describe how to Import/Export tax rates in Magento:

Step (1): Login to your Magento Admin Panel.

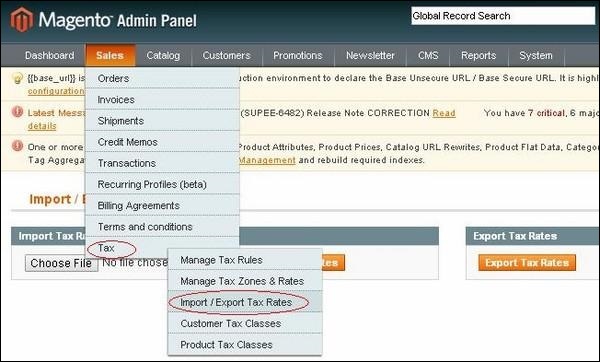

Step (2): Go to Sales menu > Tax and click on the Import/Export Tax Rates option.

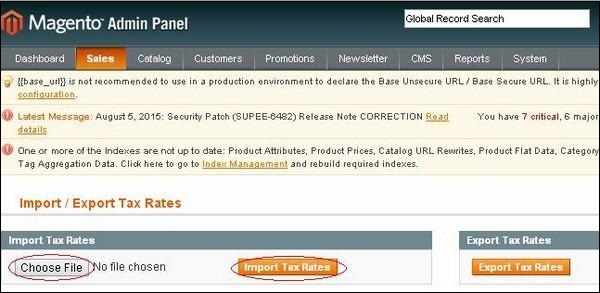

Step (3): Next it will display the window as shown below.

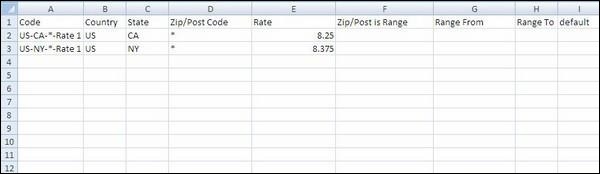

Step (3): Next it will display the window as shown below. Step (4): When you click on the Export Tax Rates button, it will download the file as shown in the below screen.

Step (4): When you click on the Export Tax Rates button, it will download the file as shown in the below screen. The spreadsheet includes Code, Country, State, Zip/Post Code, Rate,

Zip/Post is Range, Range From, Range To and Default columns. For

instance, while installing Magento, there is one tax rate for the New

York. The US-NY-*-Rate 1 means tax rate number 1 for New York which is 8.375 percent.

The spreadsheet includes Code, Country, State, Zip/Post Code, Rate,

Zip/Post is Range, Range From, Range To and Default columns. For

instance, while installing Magento, there is one tax rate for the New

York. The US-NY-*-Rate 1 means tax rate number 1 for New York which is 8.375 percent.Step (5): You can edit the file and import the tax rates into your Magento store by going to Sales menu > Tax and click on the Import/Export Tax Rates option.

Click on the Choose File button to locate the CSV file from your computer and click the Import Tax Rates button.

Click on the Choose File button to locate the CSV file from your computer and click the Import Tax Rates button.Step (6): On the Admin menu, go to Sales menu > Tax and click on the Manage Tax Zones & Rates option. The imported data appears as shown in the below screen.

No comments:

Post a Comment